The question of when to hire a financial advisor comes up constantly. And honestly, most of the answers floating around online miss the point entirely. They give you arbitrary net worth thresholds or vague life stage suggestions without addressing what actually matters: whether you are ready to benefit from professional financial planning, and whether professional financial planning is ready to benefit you.

The timing question has less to do with the number in your bank account and more to do with three elements: complexity, capacity, and commitment. Some people with $500,000 in assets desperately need professional guidance. Others with $2 million are doing just fine on their own. The difference lies in their situations, their goals, and their willingness to engage with a comprehensive wealth management professional.

What you will find here is different from the generic advice elsewhere. This is not a sales pitch disguised as “education.” What follows is a genuine framework for evaluating your readiness, built from years of watching people thrive with professional guidance and witnessing others waste money on services they didn’t actually need.

The Real Question Behind "When"

Before getting into specific triggers and thresholds, consider reframing the question entirely. “When should you hire a financial advisor?” assumes that hiring one is inevitable and that you’re just waiting for the right moment. That is not necessarily true.

The better question is: “Has my financial situation become complex enough that professional coordination would create value I cannot create on my own?” This reframing matters because it shifts your focus from arbitrary milestones to actual need.

A financial advisor is not a luxury purchase you make when you finally have enough money. A good financial advisor is a strategic investment, and someone who aims to generate value exceeding their cost, though outcomes vary based on individual circumstances. That said, if the complexity of your situation does not justify that investment, you are better off managing things yourself and revisiting the question later.

Signs Your Financial Situation Has Outgrown DIY Management

There are specific indicators that suggest you have crossed the threshold where professional wealth management becomes valuable. While net worth should definitely be taken into account, hiring a star team of financial and legal experts also comes down to how your situation’s complexity, time, and stakes intersect.

Your Tax Situation Has Layers

When your tax situation involves:

- Multiple income sources

- Investment accounts with different tax treatments

- Stock options or RSUs

- Rental property income

- Business ownership

You have officially entered territory where tax planning decisions may have meaningful financial implications. The interplay between investment decisions and tax consequences is where thoughtful planning creates real value.

If you find yourself making investment decisions without fully understanding their tax implications, or if your CPA is giving you reactive advice at tax time rather than proactive strategies throughout the year, that is a signal you shouldn’t ignore. The best financial planning integrates tax strategy into every decision, not as an afterthought but as a fundamental consideration.

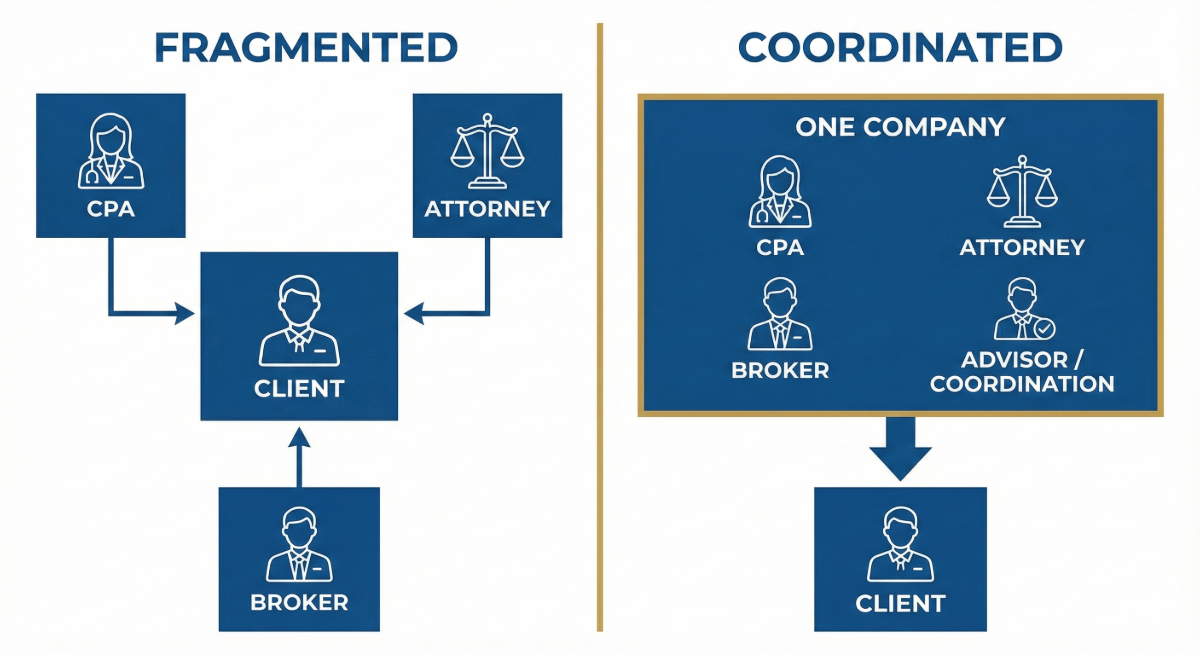

You Have Multiple Financial Relationships That Don’t Talk to Each Other

This is one of the clearest indicators. You have a 401(k) with your employer, an IRA with one brokerage, a taxable account with another, and maybe some old retirement accounts from previous jobs. You also have a separate CPA who does your taxes. Perhaps you have spoken with an estate attorney about a will at some point. Each of these professionals sees only their piece of your financial picture.

When no one is coordinating the whole picture, you end up with strategies that contradict each other, missed opportunities for improvement, and gaps that nobody catches until they turn into problems. You essentially become the project manager of your own financial life, trying to synthesize advice from multiple sources who aren’t communicating with each other at all. You miss out on the synergy that comes with a coordinated team.

Your Life Changes Are Creating Financial Complexity

Certain life events dramatically increase the complexity of your financial situation. These include coming into a significant inheritance, selling a business, going through a divorce, dealing with the death of a spouse, transitioning into retirement, or receiving a large legal settlement. Events like these don’t just change your net worth. They often expose you to financial decisions that feel entirely new and overwhelming.

The period immediately following these life-altering events is often when people make the most costly mistakes. Emotional decision making, unfamiliar territory, and time-based pressure all combine to create conditions where having professional guidance is not just helpful but potentially essential for protecting what you have.

Your Financial Goals Have Become Interconnected

Early in your financial journey, goals tend to be straightforward: build an emergency fund, pay off debt, start investing for retirement. As your wealth grows, goals become interrelated in ways that require more thoughtful planning and expert guidance.

You want to retire at 55, but you also want to fund your children’s education, support aging parents, and eventually leave a legacy. These goals compete for the same resources and require trade-off analysis. The decisions you make about one goal might affect your ability to achieve the others. Balancing multiple interconnected objectives is exactly what comprehensive financial planning is designed to address.

The Stakes Have Gotten High Enough That Mistakes Are Expensive

There is a point in wealth accumulation where the cost of getting things wrong exceeds the cost of professional guidance. If a suboptimal investment allocation costs you $50,000 over a decade, and professional management costs $30,000 over that same period, the math is straightforward. If a poorly structured estate plan results in your heirs paying hundreds of thousands in avoidable taxes, that dwarfs any advisory fee.

This brings us back to the three elements mentioned earlier: complexity, capacity, and commitment. Complexity is about whether your situation warrants professional help. Capacity is about whether you have the time and expertise to manage things effectively on your own. And commitment is about whether you’re genuinely prepared to engage with the planning process and implement recommendations.

Someone with moderate complexity but very limited time (high-capacity constraints) may benefit from professional wealth management earlier than someone with similar complexity who has both the time and interest to manage their own finances. Similarly, if you know you won’t follow through on a financial plan without accountability and support, that’s valuable self-awareness that should factor into your decision.

For some people, the crossover point comes at $500,000 in investable assets. For others, it comes at $2 million. It depends entirely on where you stand across all three dimensions.

The Readiness Checklist: What to Have in Place Before You Hire

Assuming you have determined that professional financial planning would create value for you, the next question is whether you are actually ready to engage productively. Hiring a financial advisor before you are prepared to work with one is a waste of money for you and a frustration for them.

This checklist is designed to help gauge whether you can actually benefit from the engagement. The most sophisticated financial planning in the world cannot help someone who’s not ready to participate in the process.

Financial Foundations

Complete Picture of Your Assets and Liabilities

Before any meaningful financial planning can happen, you need to know what you have. This means compiling a comprehensive list of all your accounts: retirement accounts, taxable investment accounts, bank accounts, real estate, business interests, stock options, and any other assets. Equally important is understanding your liabilities: mortgages, loans, credit obligations, and any other debts.

You don’t need everything perfectly organized in a spreadsheet, though that helps. What matters is having enough clarity on your current situation that a professional can actually help you. If you cannot articulate what you own and what you owe, you are not ready for comprehensive wealth management. Start by gathering this information, even if it takes a few weeks to track everything down.

Understanding of Your Cash Flow

You need to understand your income and expenses at a reasonable level of detail. This doesn’t mean tracking every coffee purchase. However, you do need to stay on top of your monthly income, your fixed expenses, your discretionary spending patterns, and how much you are currently saving.

This matters because any solid financial plan will involve recommendations about how to allocate your resources. If you do not understand your current cash flow, you cannot evaluate whether those recommendations are realistic. You also cannot implement them effectively. A financial plan that assumes you can save $3,000 per month when you can actually only save $1,500 is not a plan. It is a fantasy.

Documented Financial Goals

What are you actually trying to accomplish? Retirement at a certain age? Funding education for children or grandchildren? Building a legacy? Achieving financial independence? Protecting against specific risks?

You do not need perfect clarity on every goal before working with a financial advisor. In fact, helping you refine and prioritize goals is part of what a good wealth manager does. But you do need to have thought about what you want your money to do for you. If you have no sense of direction, planning becomes a theoretical exercise rather than a practical one.

Write down your financial goals, even if they feel vague or ambitious. Doing so gives you and any potential advisor a starting point for meaningful conversation.

Documentation and Records

Recent Tax Returns

Your tax returns tell a story about your financial life that no other documents can. They reveal income sources, deductions you are taking, investment gains and losses, and patterns over time. Any financial advisor worth working with will want to see at least your last two to three years of returns. If you’re a business owner you’ll need your K1’s and business tax returns as well.

If you do not have copies of your recent returns, request them from your accountant or download transcripts from the IRS. This is foundational documentation that any wealth management engagement will require.

Account Statements

Gather recent statements from all financial accounts, including brokerage accounts, retirement accounts, bank accounts, and any other investment holdings. These statements reveal your current balances, how your money is invested, what you are paying in fees, and how your accounts have performed.

This information is essential for evaluating your current situation and developing helpful recommendations. If your accounts are scattered across multiple institutions and you haven’t looked at some of them in years, now is the time to consolidate that information.

Insurance Policies

Risk management is a critical component of comprehensive financial planning and general wealth management. Gather documentation on your life insurance policie(s), disability insurance, long-term care insurance, property insurance, and liability coverage. Understanding what you have and what gaps might exist is part of the wealth management process.

Many people are either underinsured in critical areas or overpaying for coverage they don’t actually need. An objective review of your insurance situation can often identify opportunities for improvement. For example, you may have a permanent life insurance policy but not a term life insurance policy or these policies could be for too much or not enough.

Estate Planning Documents

If you have a will, trust documents, powers of attorney, or healthcare directives, gather them. If you do not have these documents, that itself is important information. Estate planning is one of the most commonly neglected areas of personal finance, and it becomes increasingly critical as your wealth grows.

Even if your existing estate documents are outdated or incomplete, having them available allows a comprehensive review of your current situation. Many people are surprised to discover that documents created years ago no longer reflect their wishes or circumstances.

Mindset and Expectations

Willingness to Be Transparent

Transparency might be the most important item on this checklist. Effective financial planning requires complete honesty about your situation, behaviors, concerns, and goals. If you are not willing to have candid conversations about money, including the uncomfortable topics, you will not get the full value from professional wealth management.

This means being honest about spending habits you are not proud of, financial mistakes you have made, family dynamics that affect your planning, and fears you may have about the future. A good financial advisor is not there to judge you. They are there to help you navigate your actual situation, not the idealized version you might be tempted to present.

Realistic Expectations About What Financial Planning Can Accomplish

Financial planning is not a magic solution that eliminates all financial stress or guarantees specific outcomes. Markets will still fluctuate. Unexpected expenses will still arise. Life will still throw curveballs. What good wealth management provides is a framework for navigating these realities more effectively and a coordinated strategy for pursuing your goals regardless of what happens.

If you are looking for someone to beat the market consistently, make you rich quickly, or eliminate all financial risk, you will be disappointed. If you are seeking thoughtful guidance, coordinated strategy, and someone to help you make better decisions over time, then you have the right mindset.

Commitment to Implementation

The best financial plan in the world is worthless if you do not implement it. Before engaging with a financial advisor, honestly assess whether you are prepared to follow through on recommendations. This might mean changing how you save, adjusting your investment approach, updating beneficiary designations, creating or revising estate documents, or having difficult conversations with family members.

Planning without implementation is just an expensive intellectual exercise. If you know yourself well enough to admit that you struggle with follow-through, either address that challenge first or find an advisor whose service model includes accountability and implementation support.

What to Look for When You Are Ready

Once you have determined that you need professional wealth management and you are prepared to engage productively, the question becomes how to choose the right advisor if even better the right team of experts. This is not a simple decision, and it deserves careful consideration. Below are some important elements to know before you commit.

Fiduciary Standard

Work with someone who is legally obligated to act in your best interest. This is called the fiduciary standard. Many financial professionals operate under a different “suitability” standard, which only requires that their recommendations be appropriate for you, not necessarily optimal. The fiduciary standard is a higher bar, and you deserve that level of care.

Ask any potential advisor directly: “Are you a fiduciary?” If they cannot clearly confirm they act as a fiduciary for all advice provided, you may want to understand the implications of different standards of care and how that affects the advice you receive.

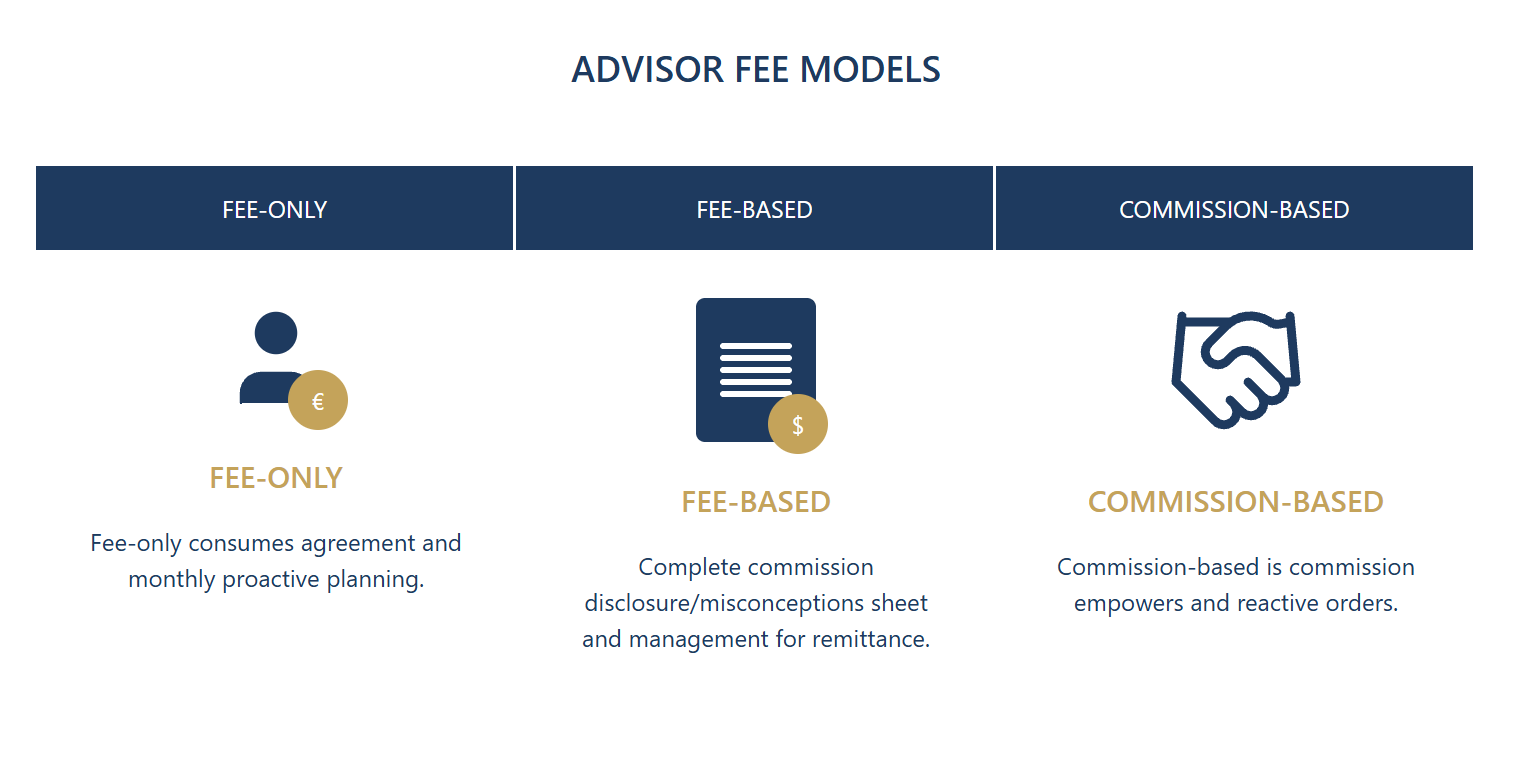

Fee Transparency

Understand exactly how an advisor is compensated before you engage. There are several common models: fee-only advisors charge directly for their services and do not receive commissions; fee-based advisors charge fees but may also receive commissions on certain products; commission-based advisors earn money primarily from product sales.

None of these models are inherently right or wrong, but you need to understand what you are paying for and how it might affect the advice you receive. An advisor who earns commissions on insurance products has a different incentive structure than one who charges a flat fee regardless of what products you use.

Comprehensive Capability

If your situation is complex enough to warrant professional wealth management, you likely need more than just investment management. Look for an advisor or firm with capabilities across the spectrum: investment management, tax planning, estate planning, risk management, and retirement planning.

At Confidence Wealth Management, we believe comprehensive financial planning is most effective when all these elements are coordinated rather than handled separately. An investment decision has tax implications. A tax strategy affects estate planning. A retirement timeline influences how aggressively you can fund education goals. Everything is connected. An advisor who can only address one piece of the puzzle may end up creating as many problems as they solve.

Team Versus Solo Practitioner

Consider whether you want to work with an individual advisor or a team. Both models have merits.A solo practitioner offers a single point of contact, but that also means their knowledge has limits and your relationship depends entirely on one person’s availability and tenure. A team brings diverse expertise and continuity.

For complex situations that require integration of tax planning, estate planning, and investment management, a team model often makes sense. No single person, regardless of credentials, can be an expert in everything. A team of specialists, including CPAs, certified financial planners, estate attorneys, and investment analysts, can address high-level needs more effectively than any sole individual.

Communication Style and Accessibility

You will be sharing sensitive information and making important decisions with this person or team. The relationship needs to work on a human level. Pay attention during initial conversations to how well they listen, whether they explain things clearly, and whether you feel comfortable asking questions or being honest about your situation.

Also, understand their service model. How often will you meet? How quickly do they respond to questions? Who will you actually be working with day to day? The world’s best expertise can only help if you can access it when you need it.

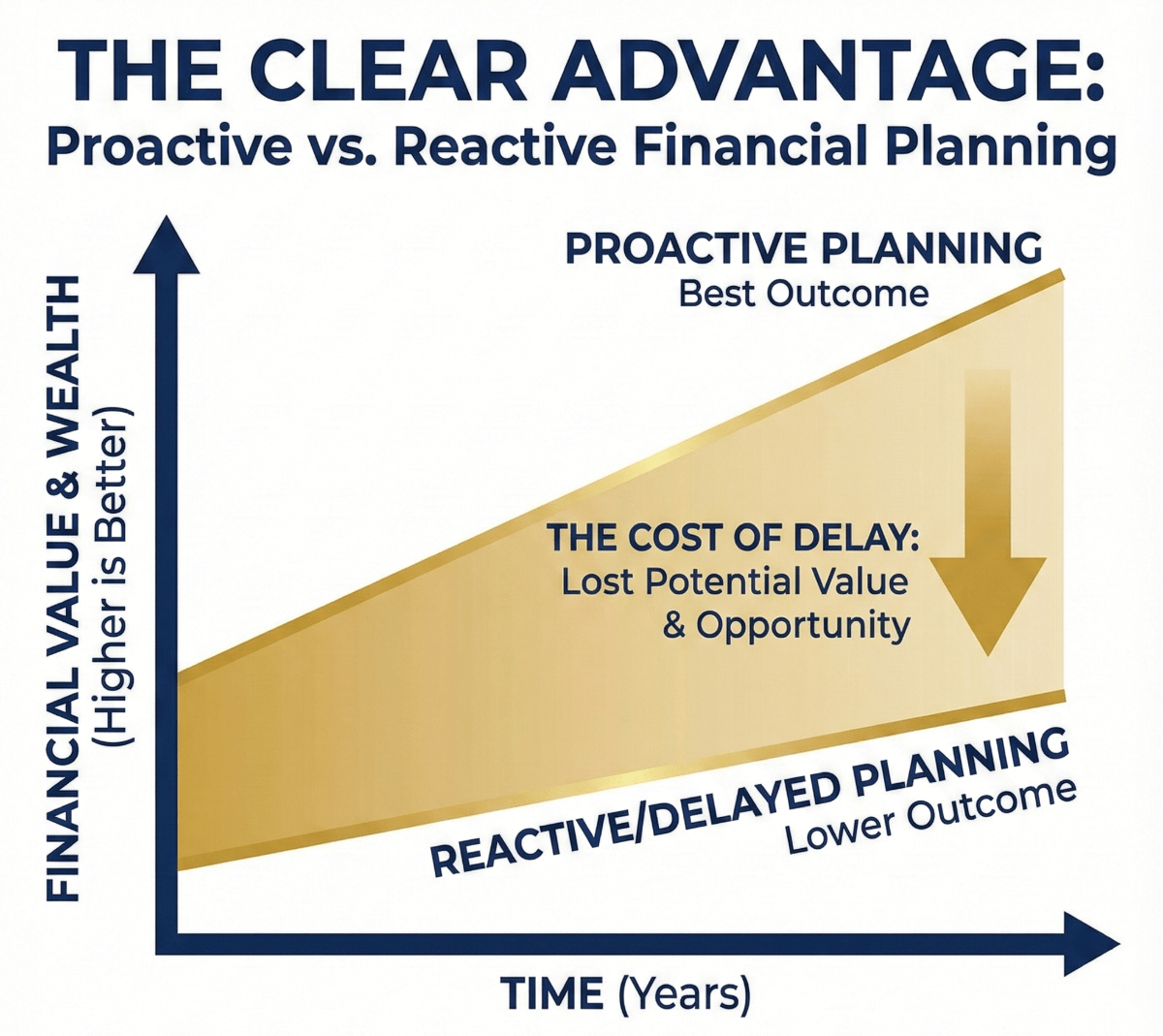

The Cost of Waiting Too Long

While this guide has emphasized that not everyone needs a financial advisor, it is equally important to address the opposite problem: waiting too long once your situation warrants wealth management.

The costs of delay compound over time. Suboptimal investment allocations create drag on your returns year after year. Tax inefficiencies add up. Estate planning gaps can result in significant consequences for your heirs. Missed opportunities become more expensive the longer they persist.

Many people put off engaging a financial advisor because they think they need to get their financial house in order first. This is backwards thinking. Getting your financial house in order is exactly what a good advisor helps you do. If your situation is complex enough to need help, waiting until it is less complex is not a realistic strategy. It will only become more complex over time.

The other common delay is waiting for some future milestone: a certain net worth, a promotion, retirement, or selling a business. While these events might trigger the need for different types of planning, the best time to engage is usually before the triggering event, not after. Planning done proactively creates better outcomes than planning done reactively.

Making Your Decision

So when should you hire a financial advisor? The honest answer is that the right time comes when the complexity of your financial situation exceeds your capacity to manage it optimally, and when the stakes are high enough that suboptimal management has real consequences.

Use this checklist to evaluate your readiness. If you have recognized yourself in the complexity indicators described earlier, and you can check off most of the preparation items on the readiness checklist, you are likely ready to have serious conversations with potential advisors.

If you are still building toward that point, focus on the foundational elements: understanding your complete financial picture, documenting your goals, and organizing your records. These preparations will serve you well whether you engage a professional advisor or continue managing things yourself.

The goal is not to hire a financial advisor for its own sake. The goal is to make good financial decisions that support the life you want to live. For some people at certain stages, professional guidance is essential to that objective. For others, it is not yet necessary. The wisdom is in knowing which category you fall into and acting accordingly.

Whatever you decide, make it an informed decision based on an honest assessment of your situation rather than arbitrary rules about net worth or age. Your financial life is too important to be governed by generic advice. It deserves the same thoughtfulness you would apply to any other significant decision.

If you are evaluating your readiness for professional wealth management, Confidence Wealth Management is happy to have a conversation about whether our approach might be a good fit for your situation. There is no pressure and no obligation. Sometimes the most valuable outcome of that conversation is clarity that you are not ready yet, and that is perfectly fine.

Disclosure: This content is for informational and educational purposes only and should not be construed as personalized investment, tax, or legal advice. Confidence Wealth Management is an SEC-registered investment adviser. Registration with the SEC does not imply a certain level of skill or training. Please refer to our Form ADV Part 2A for additional information about our services, fees, and potential conflicts of interest. Past performance is not indicative of future results. Individual results will vary based on your specific circumstances.