Planning for your future healthcare needs can be like pulling teeth, especially when you need to involve your financial advisor.

But with expenses rising, you’re not planning for your retirement if you don’t consider potential costs and how to avoid them. Healthcare costs are rising in a trend that you can safely expect will continue, and whatever you think about the future, paying for health care will play a role.

Let’s face it – lifetime employment is a relic of the past while people live longer and longer. If you want to live long and live well, you need to estimate how much to save to cover costs in retirement and include those expenses in your financial plan.

Health concerns and healthcare costs should be an agenda item at each year’s meeting with your financial advisor, no matter how old you are. When it comes to investing, the earlier you make a plan and follow it, the better your outcomes tend to be.

Here are some guidelines for building healthcare costs into your retirement plans.

Health Care Status

The first thing to pay attention to is what is most in your control: your health.

If you’re in poor health for any reason, you can expect to pay less on vacations and more on treatments and medications while in retirement.

To get a more accurate picture of your health you can rate it yourself by going to Medicare News Watch .

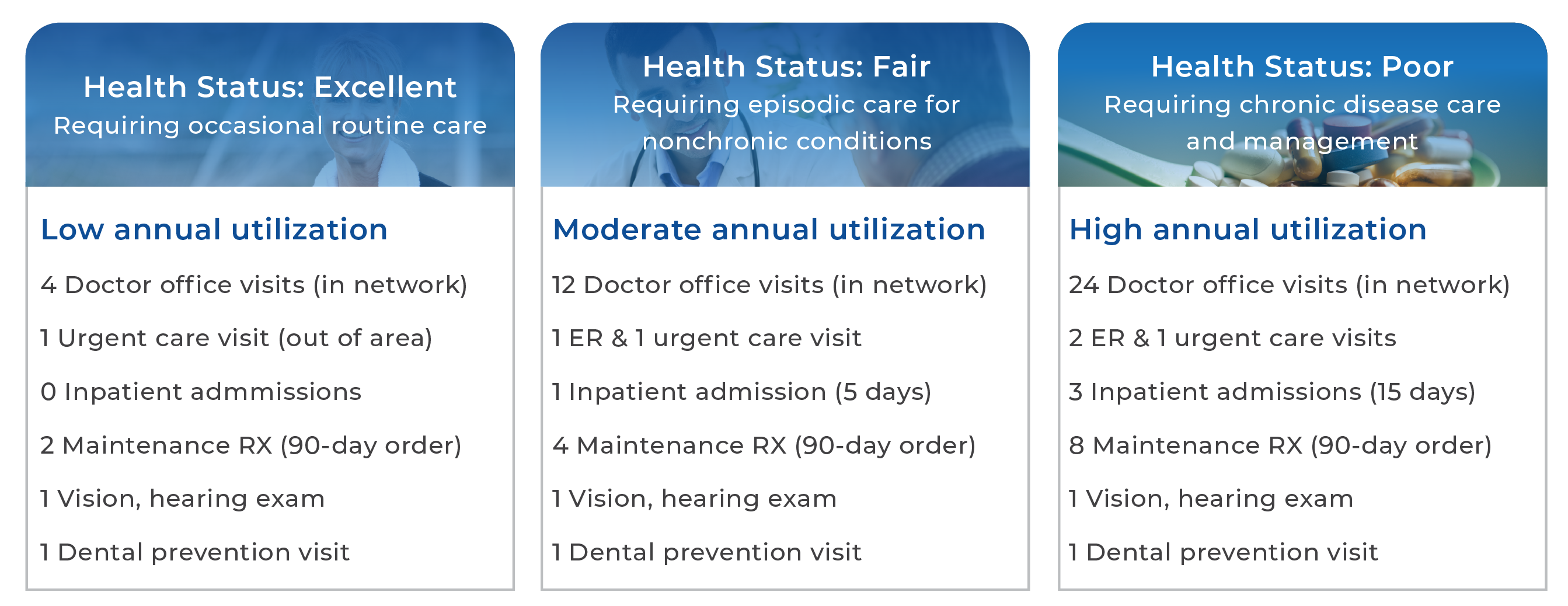

There they define three states of health—excellent, fair, or poor—very concretely in terms of the number of doctor visits per year, number of hospital admissions, and number of prescriptions.

You can also use their tools to figure out what effect your health status might have on your retirement based on your location. This can vary greatly from state to state and city to city, but a constant theme is that those in better health pay less.

This is an example of how starting early to plan your retirement can help you, as the younger you are the more able you are to make lifestyle changes that can affect how much you might pay later.

At the very least it might motivate you to get on an exercise bike or treadmill a little more often.

Of course, there are circumstances you have little control over, such as getting a cancer diagnosis. But even when disease cannot be avoided, being aware of the potential health care costs in retirement can make a difference in how you save and execute your financial plan.

Preparing For Retirement

We’ve said that the earlier you start, the better you can prepare. That means that starting in your 40s or 50s is great, but the future is still hazy enough that you can only have a vague idea of what your costs are likely to be.

By 63, you should begin planning in earnest. By then, you’ll have a more definite idea of what to expect and can better project future costs. If you’re a couple, those costs are doubled. There are no discounts for couples.

You should review your Medicare options, including premiums and co-pays, out-of-pocket costs for items Medicare doesn’t cover, and costs for unexpected events like a major health crisis.

Many experts also recommend projecting your healthcare costs assuming there will be a higher average rate of inflation than other retirement costs – which may be as much as two to four times the Consumer Price Index.

Your 63rd birthday is also a good time to dig into which specific Medicare plans you want to choose. You may even want to enroll in Medicare before you turn 65 so you don’t feel pressured to make a decision.

Consider creating a step-by-step calendar of the dates involved in signing up for the various parts of Medicare to ensure you don’t miss anything important.

In Retirement

Healthcare costs involve huge, intimidating numbers that can make you want to do anything else besides using them in your retirement plan.

For example, some experts believe that a 65-year-old couple will need about $285,000 for overall medical expenses in retirement. To give you an idea of how they arrive at a number like that, let’s use an example.

Medicare Part B, which covers outpatient care, preventive and ambulance services, and medical equipment, will cost each person about $1,985 annually (that is a $203 deductible and a yearʼs worth of $148.50 premiums.) Medical expenses are usually at least an annual $6,500 per person at the start of retirement.

Add that up over twenty years for two people and you get a high number.

The good news is that you can save up front and fund as you go. You’ll want to do this because the older you get, the more expensive your care becomes. You want to be prepared.

Conclusion

Including health care costs in your retirement planning isn’t fun, but with the right advisor, it doesn’t have to be a stressful mess.

As experienced financial professionals, we are here to help you overcome the obstacles that people often face when planning their retirement so that you can seize the opportunities before you.

Please connect with us and let us help you plan for your dream retirement. We would be delighted to go on the journey with you.