The National Bureau of Economic Research, or the NBER, announced on June 8, 2020, that February of that year marked the beginning of a recession.

The NBER defines a recession as “a decline in economic activity that lasts more than a few months.” Another common definition of a recession is two or more quarters of negative growth in gross domestic product or GDP for short.

After the NBER made this announcement, there was a lot of speculation about what the recovery would look like.

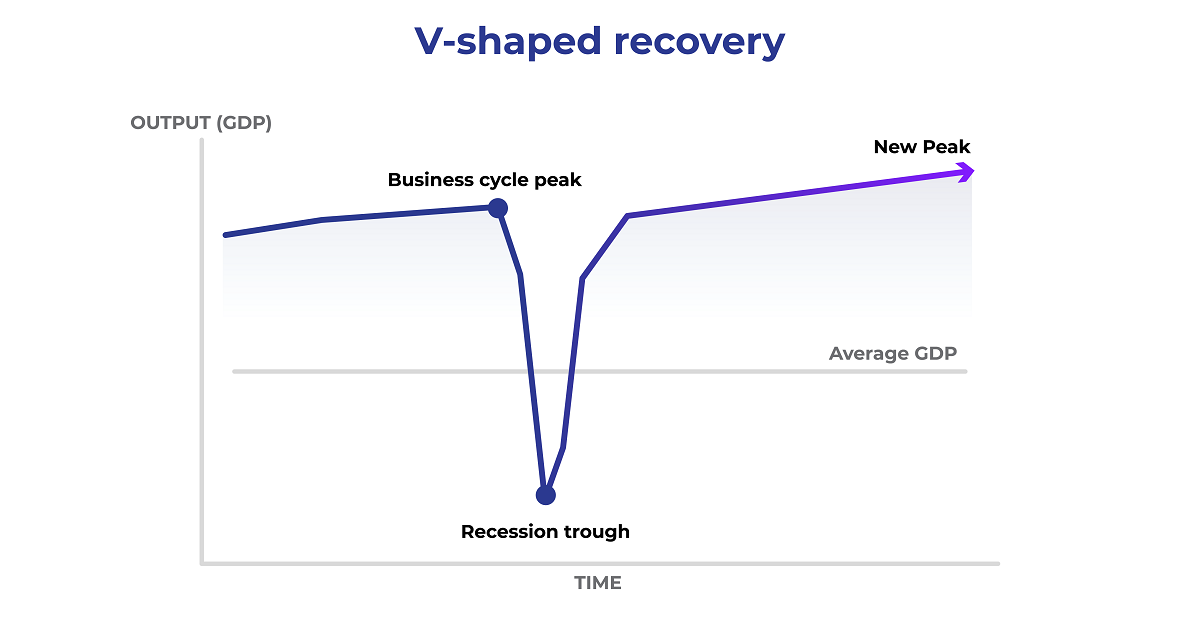

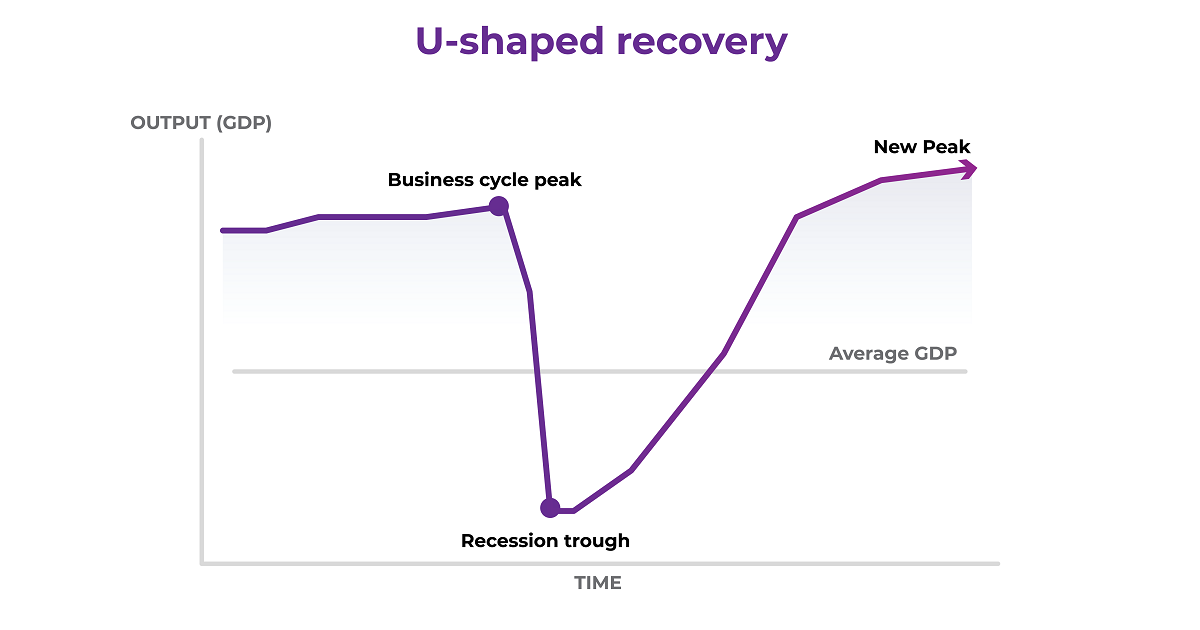

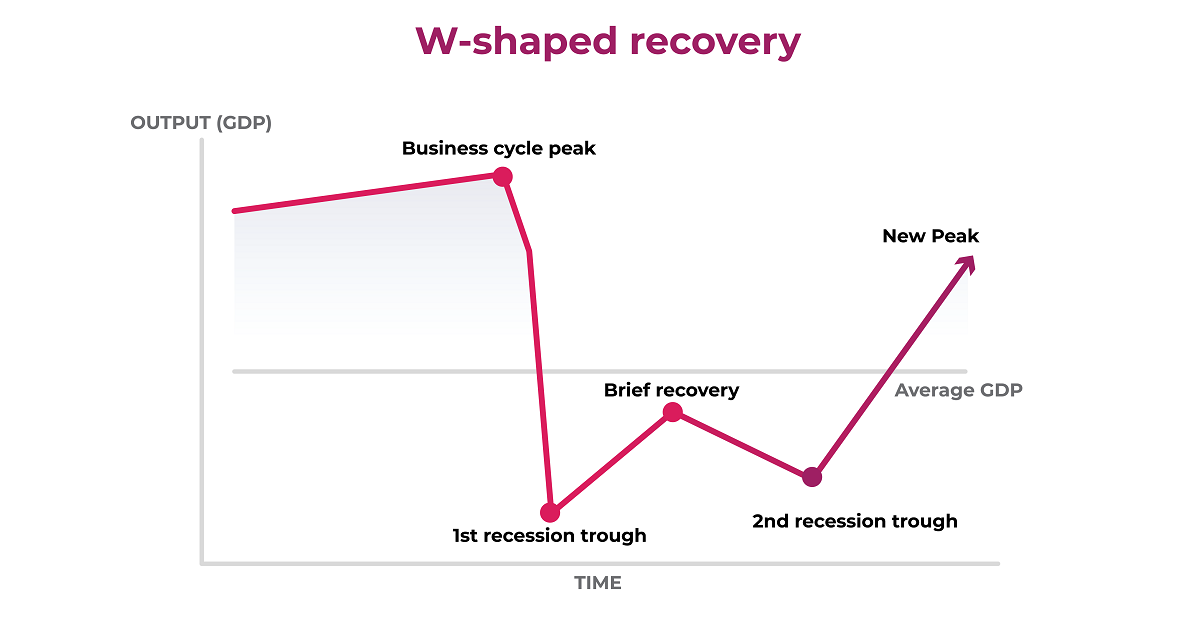

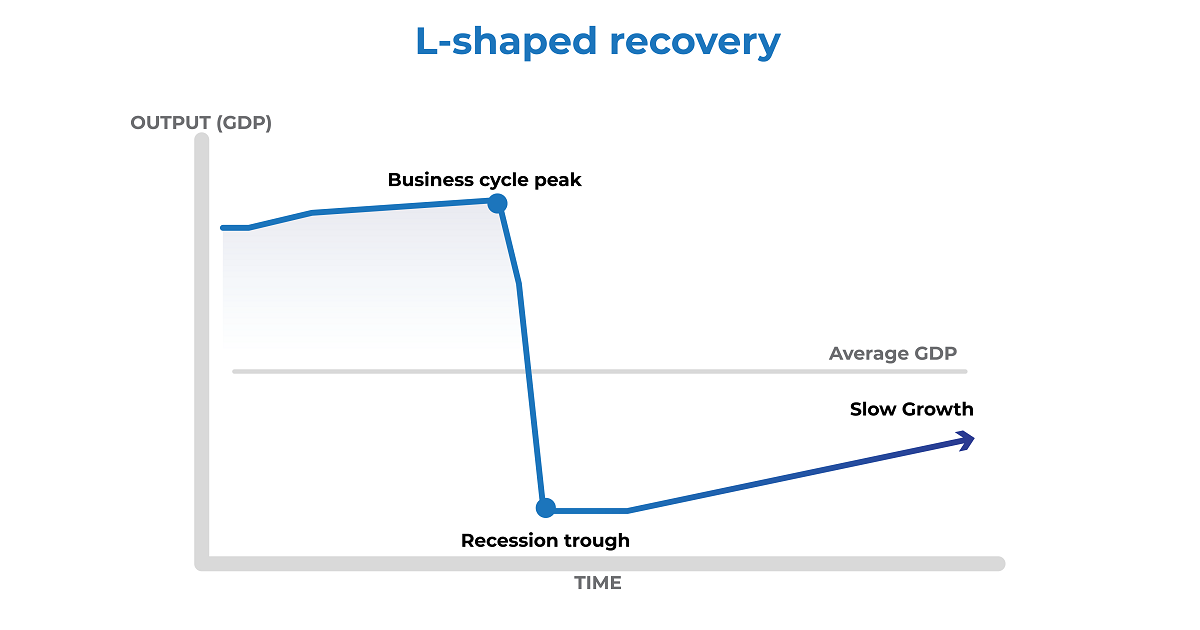

Economists traditionally view economic recessions and recoveries as having a shape, named after the letter they resemble. Here are the different so-called “shapes” of recoveries, what they look like, and what they mean.

A V-shaped recovery features a rapid fall followed by a quick rebound to previous levels. This creates a shape like the letter “V.” This type of recovery assumed that society would get control of COVID-19 through testing and treatment, followed by a quick ramp-up of business activity, and a return to pre-recession habits.

A U-shaped recovery features a longer recession before the economy slowly returns to previous levels, creating a drawn-out “V,” or “U” shape. This assumed that the virus would take longer to control and that the economy would recover much more slowly.

A W-shaped recovery is a “double-dip” recession in which a quick recovery begins but drops back sharply before beginning again. This type would occur if a second wave of COVID-19 forced businesses to shut down again later in the year.

An L-shaped recovery features a steep drop followed by a long period of high unemployment and low economic output. This is the shape of depressions like the Great Depression.

The Swoosh-Shaped Recovery

A “Nike swoosh” shape, suggests a sharp drop followed by a long, slow recovery. This view factors in the possibility that businesses may be slow to rehire, and consumers could be slow to resume pre-recession spending patterns. It also considers that some businesses may be impacted longer than others.

Although the duration of a recession may not be able to be identified immediately, the economy will eventually recover, as it has in even more challenging situations.