Table of Contents

In a financial landscape filled with uncertainties, managing risks becomes an indispensable part of building a secure future. This comprehensive guide aims to shed light on different types of investment risks and effective strategies to mitigate them. Whether you’re an investment novice or a seasoned veteran, understanding the subtleties of risk management can go a long way in fortifying your retirement nest egg.

What is Investment Risk?

In the realm of investments, the term “risk” embodies the concept of uncertainty—indicating the likelihood that your investment may not yield the expected returns or may result in a loss. This uncertainty is also reflected in how the value of an investment changes over time, known as its price volatility. The greater the swings in an investment’s price, both in frequency and magnitude, the higher its volatility. Elevated volatility often signifies a higher level of risk and uncertainty concerning the investment’s outcome.

To navigate the uncertainties in investing, it’s crucial to grasp three core components:

- Risk-Return Tradeoff: This principle posits that higher risk correlates with the potential for higher returns. Although past performance doesn’t guarantee future results, traditionally, riskier investments have offered better returns. A more aggressive investment strategy tends to involve higher risk but also offers a chance for greater returns. On the flip side, adopting a conservative approach means taking on less risk and generally expecting lower returns, albeit with a decreased likelihood of losing your investment.

- Investment Planning Time Horizon: This refers to the duration for which you intend to keep your money invested. Generally, a longer time horizon allows for a more aggressive investment strategy involving higher-risk assets. The extended period gives you the leeway to endure market volatility in anticipation of potentially greater long-term rewards.

- Types of Investment Risks: Various forms of risk can impact an investment. Some risks are inherent to the type of investment itself, while others stem from specific circumstances related to a given company, industry, or asset class.

Types of Investment Risks

Every investment, regardless of how low-risk it might appear, comes with certain inherent risks. Being cognizant of these risks will enable you to make informed decisions regarding your retirement savings plan. Here is a rundown of some key investment risks:

- Market Risk: This refers to the susceptibility of your investment to depreciation due to external factors such as economic conditions or events like political instability and natural disasters. Stocks are generally the most vulnerable to market risk, but bonds and other asset classes can also be affected.

- Interest Rate Risk: This is the risk that your investment will decrease in value if interest rates climb. Bonds are particularly sensitive to interest rate changes, although stocks can also be impacted.

- Inflation Risk: This is the risk that your investments won’t keep up with inflation, diminishing your purchasing power over time.

- Liquidity Risk: This pertains to the inability to quickly convert your investment into cash without a significant loss in value.

- International Investment Risks: These can include currency volatility, political instability, and additional taxation among other factors, and are specific to investments made outside of the United States.

Mitigating Investment Risk

The Power of Diversification: A Closer Look at Mitigating Investment Risks

Diversification stands as one of the most effective strategies to manage and mitigate investment risk. Regardless of your risk tolerance level—be it aggressive, conservative, or moderate—diversification can provide potential benefits. At its core, diversification is the practice of spreading your investments across different types of assets, industries, or geographic locations to reduce exposure to any single investment or market.

The underlying principle is that not all investments will respond the same way to economic events or market fluctuations. While one sector or asset class may be declining, another may be rising or holding its value. By holding a diverse array of assets, you’re less likely to experience large-scale losses.

Types of diversification

- Asset Class Diversification: This involves investing in different categories of assets like stocks, bonds, and real estate. Each asset class has its own risk profile and potential for returns, and they often move in opposite directions.

- Sector Diversification: Within an asset class like stocks, there are various sectors such as technology, healthcare, or utilities. Different sectors react differently to market conditions, providing another layer of risk dispersion.

- Geographic Diversification: Investing in different markets around the world can also help mitigate the risk associated with economic downturns in one particular country or region.

- Time Diversification: This involves spreading out your investment over time, also known as dollar-cost averaging. This approach reduces the risk of investing a large amount at an inopportune moment.

The Role of Asset Allocation in Risk Mitigation

Asset allocation is often considered the sibling of diversification in the realm of investment strategies aimed at mitigating risk. While diversification focuses on spreading investments across various types of assets, industries, or geographies, asset allocation is more about strategically distributing your capital among different asset classes, such as equities, fixed income, and cash or cash equivalents, based on your investment objectives, risk tolerance, and investment horizon. The goal is to optimize the risk-reward ratio according to an individual investor’s specific needs and goals. Each asset class has a different level of risk and return, so each will behave differently over time.

Asset allocation reduces portfolio volatility by combining assets that are not perfectly correlated. For example, when stock prices are falling, bond prices might remain stable or even increase, providing a cushion against significant losses. This interplay between asset classes can help mitigate the effects of market volatility, providing a more stable overall return.

Rebalance to stay on target

As market conditions evolve, your original asset allocation can drift due to varying performance rates among different asset classes. There are primarily two avenues for rebalancing your portfolio. One approach is to sell off some assets from the class that’s now overrepresented, using the proceeds to buy more of the underrepresented assets. Another strategy involves funneling fresh investments into the asset classes that have fallen below your target allocation, thereby restoring the balance without selling off existing assets.

Be mindful that the act of selling assets could trigger tax liabilities, unless those assets are housed in tax-advantaged accounts like an employer-backed retirement plan or an Individual Retirement Account (IRA). Rebalancing, therefore, isn’t just about realigning with your risk profile; it also warrants consideration of the potential tax implications.

Leverage Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy that involves systematically purchasing a fixed dollar amount of a specific investment, like a stock or mutual fund, on a regular schedule regardless of its price. This approach can serve as a risk mitigation tool, especially for investors who are concerned about market volatility. Here’s how leveraging dollar-cost averaging can help you manage investment risk:

Smoothing Out the Market’s Ups and Downs

Investing a consistent amount of money at regular intervals, regardless of share price, allows you to buy more shares when prices are low and fewer when prices are high. This can help to average out the cost basis of your investment over time, thereby reducing the impact of market volatility on your portfolio.

Psychological Benefits

Dollar-cost averaging takes the emotion out of investing to some extent. It eliminates the need to time the market, which can be stressful and fraught with risk. By committing to a fixed, regular investment, you can stay disciplined and avoid impulsive decisions based on market conditions.

Reduced Impact of Market Timing

One of the biggest risks in investing is entering the market at the wrong time, particularly if a large sum is invested just before a downturn. By spreading your investments over a longer time frame through dollar-cost averaging, you minimize the risk associated with poor market timing.

Mitigating the Cost of Mistakes

If you make an investment that doesn’t pan out as expected, the losses are generally smaller when using a dollar-cost averaging strategy. Since you are not investing a large sum all at once, your exposure to any single market event or investment decision is limited.

Increasing Flexibility

Dollar-cost averaging offers the flexibility to adapt to your financial circumstances. If you experience a financial setback, you can reduce the amount you invest without abandoning your investment strategy altogether.

Regular Portfolio Maintenance is Crucial

While daily or even weekly monitoring of your retirement portfolio isn’t usually required, it’s wise to give it a thorough review at least annually or when significant life changes occur. During these evaluations, reassess your comfort level with risk to see if it aligns with your current circumstances. Additionally, examine your asset distribution to make sure it remains consistent with your initial investment goals, assuming they still apply. You may need to readjust your investments to recalibrate your asset allocation back to your intended targets. Keeping your portfolio in tune with your evolving life conditions is a key step in effectively managing investment risk.

Assessing Your Risk Tolerance

Determining your personal risk tolerance is essential for making the right investment choices. Risk tolerance is your capacity to endure potential losses in your account owing to market volatility. When it comes to investments, your comfort with risk has two facets:

- Financial Capacity for Risk: This is purely about the numbers. Can you afford a loss without jeopardizing your livelihood? If an investment doesn’t pan out, would it spell disaster or just a hiccup?

- Emotional Quotient for Risk: This has to do with how you emotionally cope with the possibility of loss. Your age, goals, knowledge about investing, and prior experience can influence this.

So, how do you personally feel about taking risks? Investors usually fit into one of three categories: Aggressive (high risk-tolerance), Conservative (low risk-tolerance), or Balanced (somewhere in the middle).

Here are some questions that can guide you in assessing your risk tolerance:

- How much money do you aim to accumulate to ensure a comfortable retirement? The higher the amount, the greater the risk you may need to assume.

- What would be your reaction if your investments declined by 5%, 10%, or even 20%? Would you switch to more stable options or remain invested for potential long-term gains?

- How long until you will require the funds? A longer investment horizon generally allows for greater risk-taking.

- Do you have other financial safety nets, such as an emergency savings account? Having additional savings can make you more comfortable with taking on investment risks.

The Two-Pronged Approach Risk Tolerance

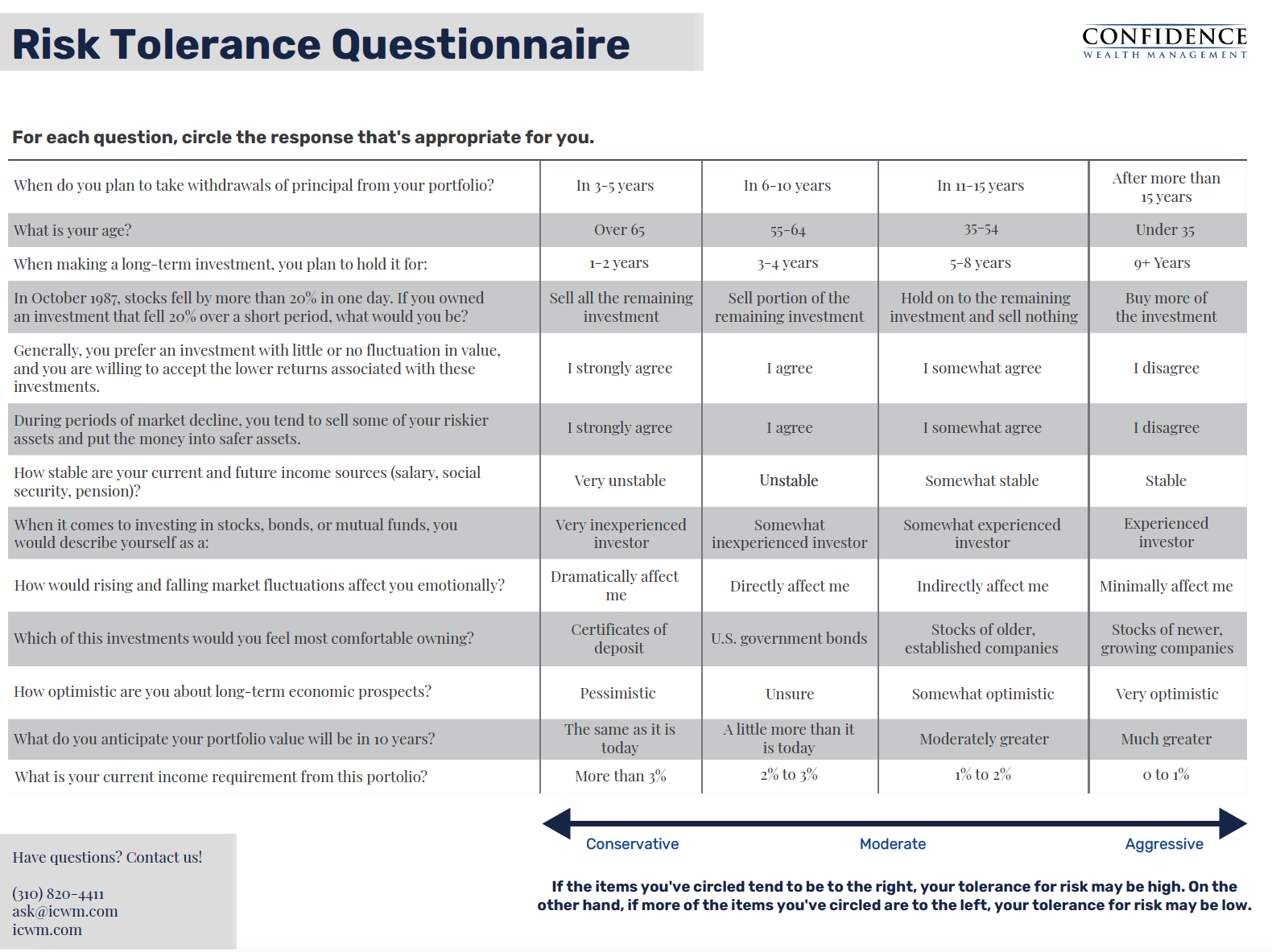

There are various tests designed to evaluate your risk tolerance, and while they aren’t perfect, they can offer valuable insights. Typically, these questionnaires can be grouped into two main categories: Investment Preference and Psychological Risk.

• Investment Preference

These are straightforward surveys that ask you about your existing financial circumstances, your investment goals, and any prior experience you may have with investing. They’re quite easy to complete and understand. However, one limitation is that they often focus more on your financial situation than on your emotional response to risk, which could lead to an inaccurate assessment of your true risk tolerance.

• Psychological Risk

These are more nuanced tests designed to delve into your psychological makeup and how it influences your attitude toward risk. The questions might touch on your emotions, behaviors, or ask you to consider your reactions to hypothetical investment scenarios. While these assessments can be engaging to complete, they come with their own set of challenges. For instance, some people may overestimate their comfort with risk, only to realize they are less tolerant when faced with actual market volatility.

Both types of tests aim to offer a comprehensive understanding of your comfort with risk, albeit from different angles. While not infallible, they can serve as a useful starting point for any investment journey.

Risk Tolerance Questionnaire

Only you can know what your level of risk tolerance is when it comes to investing.

Will Your Risk Tolerance Change? Be Prepared to Adapt

It’s worth noting that your comfort level with investment risk might not be set in stone, although experts differ on this point. Various internal and external conditions can influence how you perceive and react to risk. For example, changes in your familial responsibilities or sweeping economic shifts can impact your willingness to take on risk. As such, it’s prudent to remain flexible and ready to adjust your investment strategy in response to these evolving circumstances.

Conclusion

Retirement planning is more than just a set-it-and-forget-it endeavor. Your risk tolerance, financial goals, and the economic climate can all undergo changes over time. Being proactive in understanding the various types of risks and employing effective mitigation strategies can make a world of difference. Regular maintenance, asset allocation, and diversification are not merely buzzwords; they are foundational elements in the art and science of investment risk management. By continually assessing and adjusting your retirement investment plan in line with your evolving needs and market conditions, you can significantly increase the likelihood of achieving a financially secure retirement.