Many people make the mistake of avoiding investing because they’re worried about short-term volatility.

Don’t be one of them. Use dollar cost averaging instead.

This popular investment strategy takes some of the guesswork out of the game. Instead of holding onto a lump sum and waiting for the market to reach its lowest point, agonizing over whether it might tick down another sliver, you invest small amounts at regular intervals.

And you do this with the same amount each time, no matter how the market is performing.

Your goal is to overcome the volatility and reduce the overall cost of investing by purchasing more shares when the price is low and fewer shares when the price is high.

Although dollar cost averaging can’t guarantee a profit or protect against a loss in a declining market (nothing can), over time your average cost per share is likely to be less than the average market share price.

And you’ll have saved yourself agony while getting in at a good price.

Dollar Cost Averaging in Detail

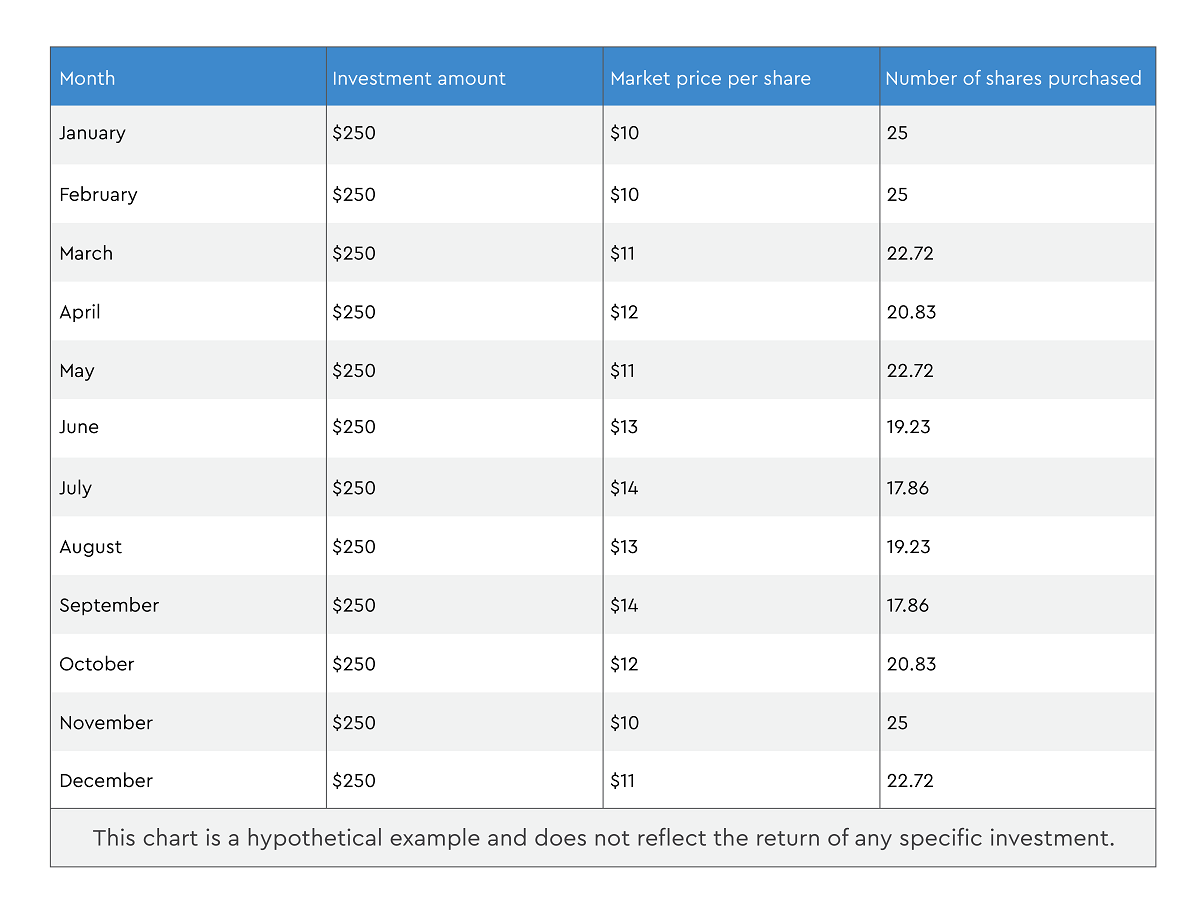

To illustrate, let’s say that you want to save $3,000 each year. To reduce the risk of buying when the market is high, you decide to invest $250 in a mutual fund each month.

As the following chart shows, this approach can help you take advantage of fluctuating markets because your $250 automatically buys fewer shares when prices are higher and more shares when prices are lower.

If you calculate the average market price per share over the 12 months ($141 divided by 12), the result is $11.75.

However, if you calculate your average cost per share over the same period ($3,000 divided by 259 shares), you’ll see that on average, you’ve paid only $11.58 per share.

Putting Dollar Cost Averaging to Work for You

If you’re investing a regular amount in a 401(k) or another employer-sponsored retirement plan via payroll deduction, you’re already using dollar cost averaging.

You can use dollar cost averaging to invest for any long-term goal.

It’s easy to get started, too. Many mutual funds, 529 plans, and other investment accounts allow you to begin investing with a minimal amount as long as you have future contributions deducted regularly from your paycheck or bank account and invested automatically.

If you’re interested in using this strategy, here are a few tips to help you put this strategy to work for you:

- Get started as soon as possible. Once you’ve decided that dollar cost averaging is right for you, start investing right away. The longer you have to ride out the ups and downs of the market, the more opportunity you have to build a sizable investment account over time.

- Stick with it. Dollar cost averaging is a long-term investment strategy. Make sure that you have the financial resources and the discipline to invest continuously through all types of markets, regardless of price fluctuations.

- Take advantage of automatic deductions. Having your investment contributions deducted and invested automatically makes the process easy and convenient.

Conclusion

Once you think you’re ready, consider talking to a financial advisor. It can be a huge help having someone well-versed in the markets advise you in your decisions moving forward.

As experienced financial professionals, we help clients like you figure out the best retirement plan for their situation, so that when they’re ready they can retire gracefully with peace of mind.

Please connect with us and let us help you plan for your dream retirement. We would be delighted to go on the journey with you.