As market volatility threatens financial security across the globe, some are quietly using these two often-overlooked strategies to re-assess their exposure.

If you’re concerned about your retirement fund, you’re not alone.

Millions are reeling from the toll the COVID-19 crisis has taken on the U.S. economy.

Few things have become more dramatically uncertain than the future of stock portfolios.

According to Fidelity Investment’s quarterly assessment of retirement trends, the average 401(k) and IRA was down 19% and 14%, respectively, by the end of the first quarter – a massive blow to those with portions of their net worth tied up in equities.¹

In a matter of weeks, previously secure retirees have watched their passive streams of income from dividend-paying stocks, interest from savings, municipal bonds, and other investments simply dry up.

While certain optimistic market experts are of the opinion that the crisis will be short-lived, retirement-aged investors and business owners have real reasons to be skeptical.

Here’s what such “optimistic” forecasts might not be taking into account:

1. The coronavirus recession is not like any economic downturn in our lifetime. It might be tempting to compare the current economy to the economic situation after September 11th, 2001. However, it’s important to recall that the shock that disrupted the real economy and several industries in 2011 happened in a very different time. Due to the earlier dot com crash, stock valuations were already lower. Interest rates were higher then, and balance sheets less stretched. In layman’s terms, the economy in 2001 was poised for a much speedier return to normal than is currently possible.² Many experts describe the current challenges to our economy as “unprecedented.”“It is very likely that this year the global economy will experience its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago.” -IMF World Economic Outlook 2020³2. A V-shaped recovery model is a tremendous long-shot. Since the start of the crisis, there’s been much speculation around a possible “V-shaped recovery” – where we see our economy snap back into place like a rubberband. Excessively optimistic advisors have painted a picture where states are quickly reopened, and consumers flock back to businesses in droves to deliver a much-needed injection of cash back into the economy. The problem is, this simply doesn’t align with the nature of this crisis. We may see a gradual relaxation of restrictions across the U.S. We will surely see most businesses reopen their doors eventually. But we may also see the public health crisis seesaw for months to come. The effects of coronavirus are far from over – and with the future of a vaccine uncertain (and mass production happening no time in the near future), it’s safe to assume we should expect periodic reintroduction of strict controls.

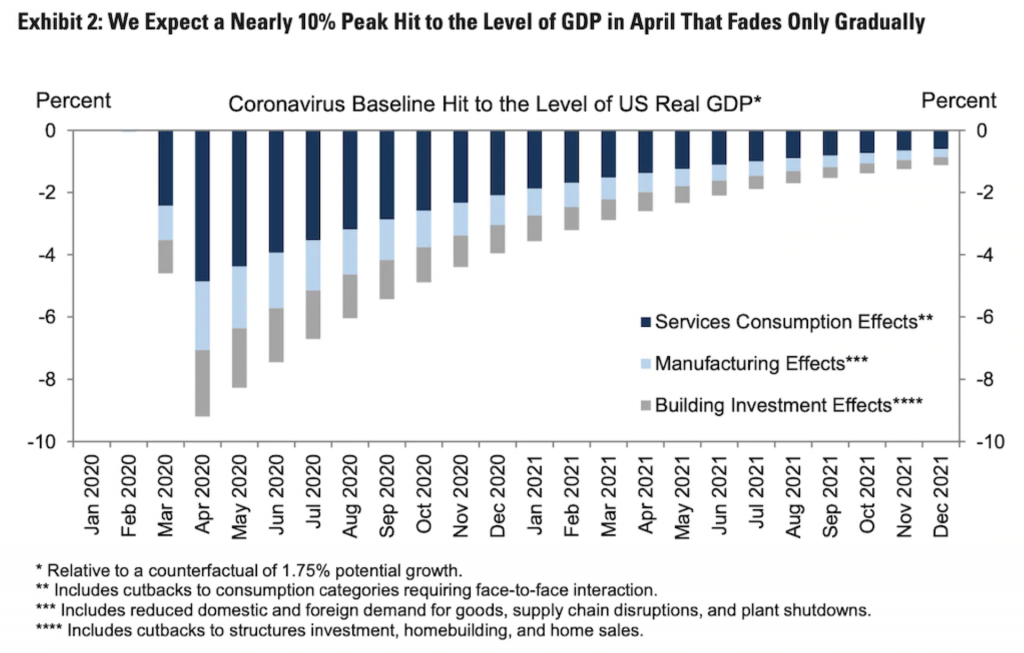

Clearly, we’re in for a more tepid, U-shaped recovery. But how long will it take?

No one can know for sure. But one thing is certain – factors like lower growth, decreased demand for products and services, lowered wages, and deflationary pressure on product prices make any hope of a speedy recovery far too unrealistic for the cautious investor to stake their financial future on.

Goldman Sachs predicts US GDP will shrink 24% next quarter – 2.5 times larger than any decline in history.⁴

Here’s what a U-shaped recovery could look like, stretched out over the next 6 months:

- Without cash flow, risky assets such as stocks, residential and commercial real estate, and infrastructure, could become worth much less.

- Consumer demand may drop dramatically – on a scale unseen since the U.S. lost around $10 trillion from drawdowns in savings, falling values of houses, and investments during the Great Recession.

- Large sectors of the global economy – even previously insulated industries – should see negligible revenue, losses, no dividends and insolvencies.

Can I really afford to gamble a lifetime of hard work on optimistic projections?

Do you think now is the time to borrow from the investment playbook of the ultra-wealthy? In times of crisis, rather than sit still and hope for a miraculous turn of events, the ultra-wealthy take immediate action – and the first step typically involves seeking advice. So before you rush to talk to your financial advisor about adjusting your investment strategy, you must FIRST gauge your current exposure.Here are two simple things you can do RIGHT NOW to gauge your exposure during the Covid-19 crisis:

The first is to “stress test” your portfolio. Like a weather model, a stress test will allow you to model different possibilities and determine their effects on your financial future. This allows you the unique opportunity to:

- Identify the weak spots in your financial armor – how volatile your portfolio actually is in crisis-time.

- Visualize what would happen to your equities in a “worst case” scenario, i.e. if the Covid-19 crisis were to last another 6 months, 1 year, or even 2 years.

- Start developing a plan to deal with and mitigate these risk factors.

- Missing market trends for Buy vs. Sell

- Tunnel vision with select portfolios or stock options

- Unbalanced and non-diversified funds

- Transaction hesitation given perceived environment factors

Download your copy!

The Consumer’s Guide to Stress Testing Your Portfolio

Take the best plays from the ultra-wealthy’s financial playbook.

Inside the guide:

✔︎ Is It Time to Stress Test Your Wealth Plan?

✔︎ The Super Rich Stress Test Their Financial Plans—and so Should You!

✔︎ Stress Testing Your Wealth Plan: Three Keys to Success

✔︎ Stress Testing for Successful Business Owners

References:

¹ fidelity.com/bin-public/060_www_fidelity_com/documents/press-release/Q1-retirement-trends-042420.pdf

² marketwatch.com/story/were-unrealistic-about-the-economys-recovery-from-the-coronavirus-and-this-black-hole-illusion-will-cost-us-2020-04-29

³ reuters.com/article/us-imf-worldbank-outlook/global-economy-in-2020-on-track-for-sharpest-downturn-since-1930s-imf-idUSKCN21W1MA

⁴ markets.businessinsider.com/news/stocks/us-gdp-drop-record-2q-amid-coronavirus-recession-goldman-sachs-2020-3-1029018308