We're your fiduciary advisor — matched by SmartAsset!

More than a financial firm; it’s a promise.

A promise of expertise, innovation, and unwavering support. We will not just craft financial strategies; we’ll sculpt legacies. Your legacy!

Q&A with Rem Oculee

Private Wealth Management

Crystal Oculee on CBS Los Angeles

Optimal Financial World

The Right Firm for You

The measure of a good financial plan is not when the economy is up; it’s when it’s down.

Family Wealth Solutions

For family members who want to secure, safeguard, and protect their family financial wellbeing

Business Wealth Solutions

Leveraging higher level strategies—exclusively for business owners

Business Exit Solutions

Solutions to maximize the value of your business when you are ready

to sell

64% of workers are not confident that they will have enough money to live comfortably throughout their retirement years

Source: 2023 report by the Employee Benefit Research Institute

As many as 20% of investors are unaware that their investments have fees, and another 36% do not know how much they are paying in fees. These fees can significantly eat into their returns over time.

Source: CNBC

The analysis of 2018 data previously found that 80%—or 47 million households with older adults—are financially struggling today or are at risk of falling into economic insecurity as they age.

Source: National Council on Aging

60-70% of businesses don’t sell and expire worthless.

Source: Family Business Institute, 2020

70% of family businesses don’t survive the transition to the second generation.

Source: InvestmentBank.com

Our Expert Team

We live and work by a strong code: loyalty, dependability, transparency, diligence, resilience, compassion, courage, and integrity.

Our team of private wealth advisors and professionals possess all of these qualities, and that’s why we feel confident to have them represent us as we deliver value to you.

Founder and CEO

CTS®, CES®,

CEPA®, CIS®, NSSA®, CFS®, CAS®

Chief Financial Strategist

CFP®, MBA

Lead Financial Planner

CIS®, CES®, CAS®, CFS®

Wealth Advisor

Wealth Advisor

AIF®, MBA

Chief Retirement

Plans Officer

CFP®, CLU®

Wealth & Estate Advisor

MBA

Vice President of

Client Operations

Advisor Operations

CFP®

Wealth Advisor

CTC, PMEC

Chief Compliance Officer

CFA®

Portfolio Analyst

CPA

Chief Financial Officer

Insurance Strategist

Relationship Management

Infrastructure and Technology Deployment

Operations Management

Client Services

Operations Associate

Operations Associate

Accounting Associate

Network Administrator

Data Management

Project Associate

Here’s what you will get during your consultation... and more

Valuable educational materials. We have a proven track record of working with high-net-worth individuals and families, and we have an A team that genuinely cares about our clients.

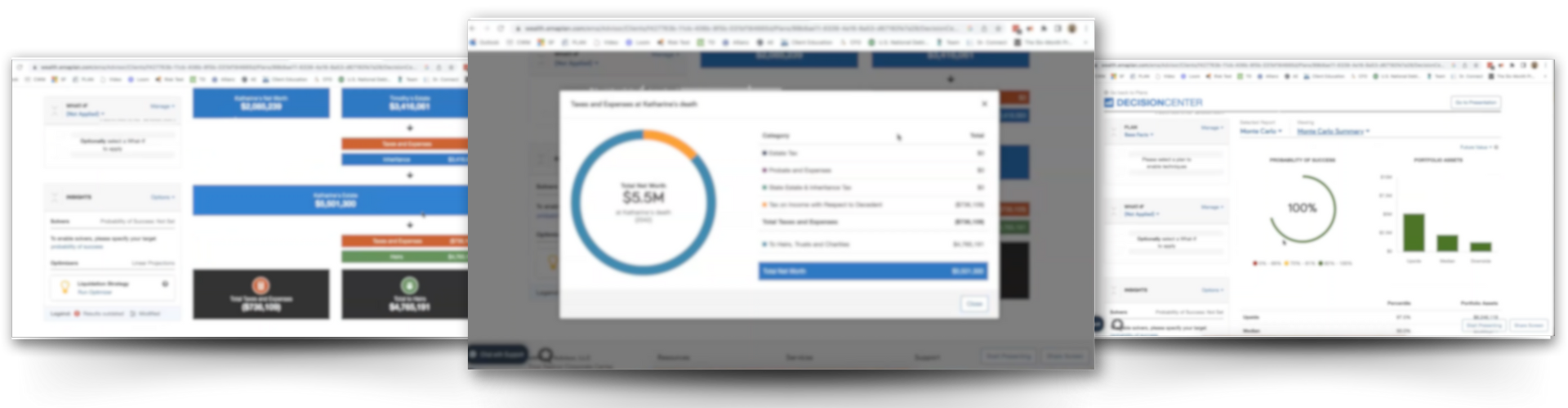

Net Worth Building Report

A lower net worth often equates to a constrained lifestyle. Our report not only provides you with an accurate picture of your current financial standing but also offers actionable steps to enhance your net worth and, by extension, improve your quality of life.

Future Quality of Life Report

No one dreams of downgrading their lifestyle, yet many find themselves in that unsettling reality due to inadequate planning. Our report goes beyond telling you where you stand today—it serves as a critical alert system that triggers action needed to achieve success and financialstability early.

Cash Flow Report

A strong cash flow is the backbone of a secure financial future. Our Cash Flow Report provides you with a comprehensive overview of your income and expenses, along with tailored recommendations for optimizing your cash flow.

Estate Planning Report

Our Estate Planning Report provides a comprehensive look at your current estate plan, highlighting areas that might have been missed or overlooked. More crucially, it assesses the readiness of your heirs to handle potential tax implications and potential disputes that can arise, ensuring a smooth transition and protection for your legacy.

Tax Opportunities Report

Taxes can significantly erode your wealth over time. This report identifies tax-saving opportunities you may be missing and outlines strategies to minimize your future tax burden. Tax-efficient strategies can save you thousands, tens of thousands, or even hundreds of thousands over the long term, helping you build a nest egg for a more comfortable financial lifestyle. Without strategic planning, you’re likely giving away more of your hard-earned money to taxes than you need to.

Confidence Wealth Management Pilanthropy

We are deeply committed in helping people transform their lives beyond wealth. Confidence Wealth Management invests in the success of our communities and the world by partnering with charities and organizations who share our values and purpose.

Habitat for Humanity

Habitat for Humanity is a nonprofit organization that helps families build and improve places to call home. They believe affordable housing plays a critical role in strong and stable communities

Mentors International

Creating a lasting impact, not a fleeting relief. Their mission is to transform generational poverty into sustainable self-reliance through mentoring, business training, vocational education, and access to micro-loans. On average, each $1 donated creates 3.5X of economic impact in the lives of mentored families.

Maui Strong Fund

In response to the devastating wildfires across the island, the Hawaiʻi Community Foundation is activating the Maui Strong Fund. The Maui Strong Fund is providing financial resources to support the immediate and long-term recovery needs for the people and places affected by the devastating Maui wildfires.

HAVE QUESTIONS? CONTACT US.

(310) 820-4411 ・ icwm.com ・ ask@icwm.com

© 2023 Confidence Wealth Management LLC. All rights reserved.

Confidence Wealth Management LLC (CWM) is an SEC registered investment adviser. Confidence Wealth & Insurance Solutions LLC (CWIS) is licensed under the NV Department of Insurance, license no. 3647322. CWM and CWIS are two separate affiliated companies. All investment advisory services are provided by CWM and all insurance products and services are provided by CWIS. CWIS does not provide any investment advisory services and CWM does not provide insurance services. CWM and CWIS have no affiliation with government, state, or local agencies. Consult with an attorney or CPA for usage of tax or legal concepts. This material may contain information that are close approximation to the totality of information available to us and not necessarily specific within regards to one situation or another. Some opinions and statements are informational. They are not investment advice as they may not be complete in terms of all details needed to affect an action you wish to undertake, investment strategy or plan. Pursuant to IRS Circular 230, the material is not intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. No estimates used are a promise of return. Also, many opinions are summaries and may not reflect all pertinent facts relevant to you. Any information given is to be considered general, and nothing said herein should be used as a basis for investment decision unless you consult with your Confidence Wealth advisor that can understand your unique situation and give you a customized solution with a complete disclosure. Past performance does not indicate future results. As you know, no one can predict the future. Thus, any forecast in this material is intended strictly as a possible future outlook and not a statement of fact as there could be any scenarios that are not in your favor when making a decision. You must examine all adverse and negative implications on any forecast when made. All information is based on the date of the material and may not be valid, may change, and/or may not be true any longer as time passes.

Form ADV Part 2A for CWM contains detailed disclosures regarding our services and fees, along with applicable conflicts and how we address such conflicts. A copy of our Form ADV can be obtained by calling (310) 824-1000 or from adviserinfo.sec.gov