Retirement Readiness

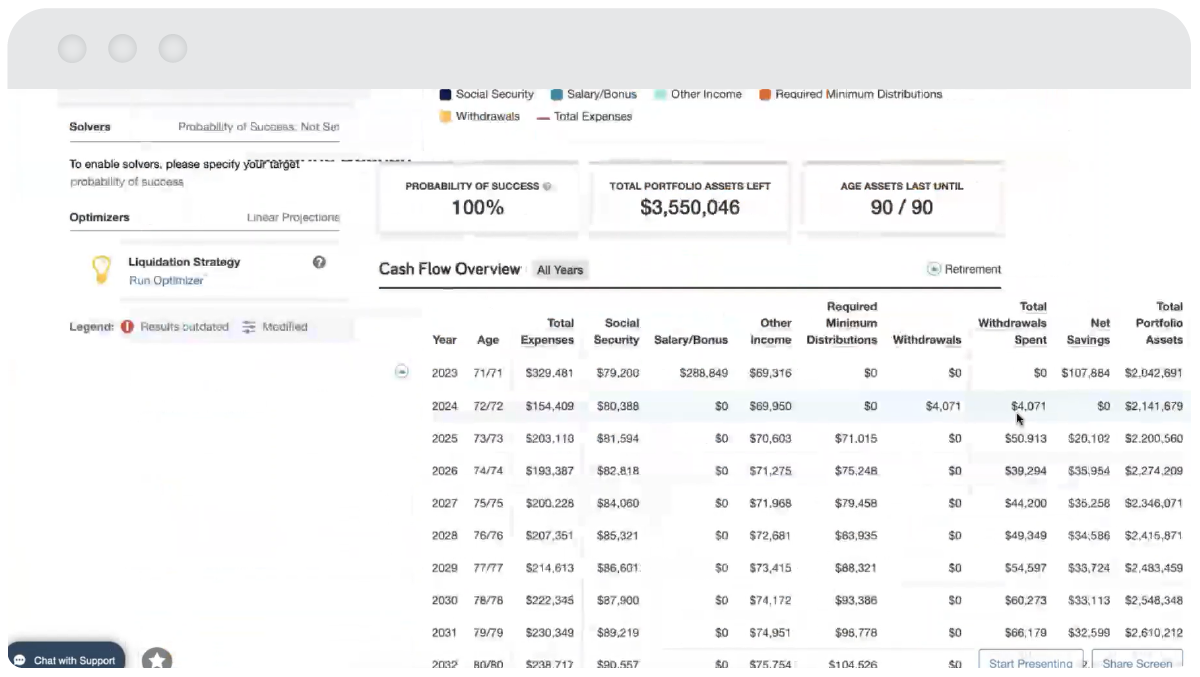

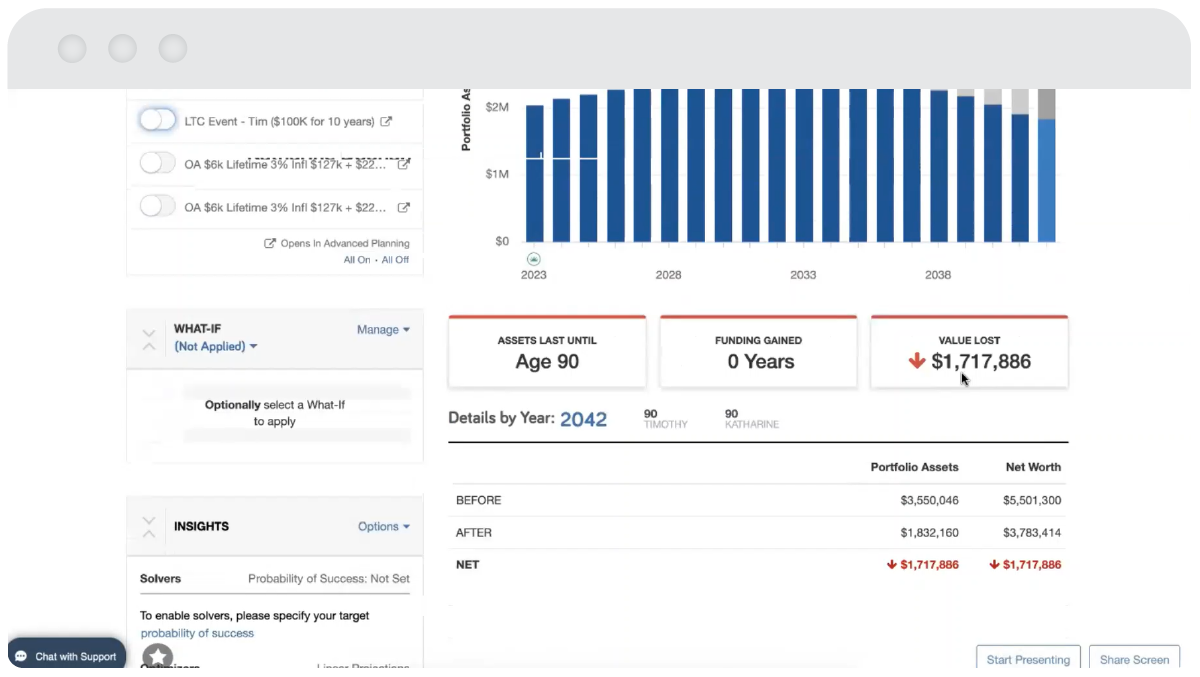

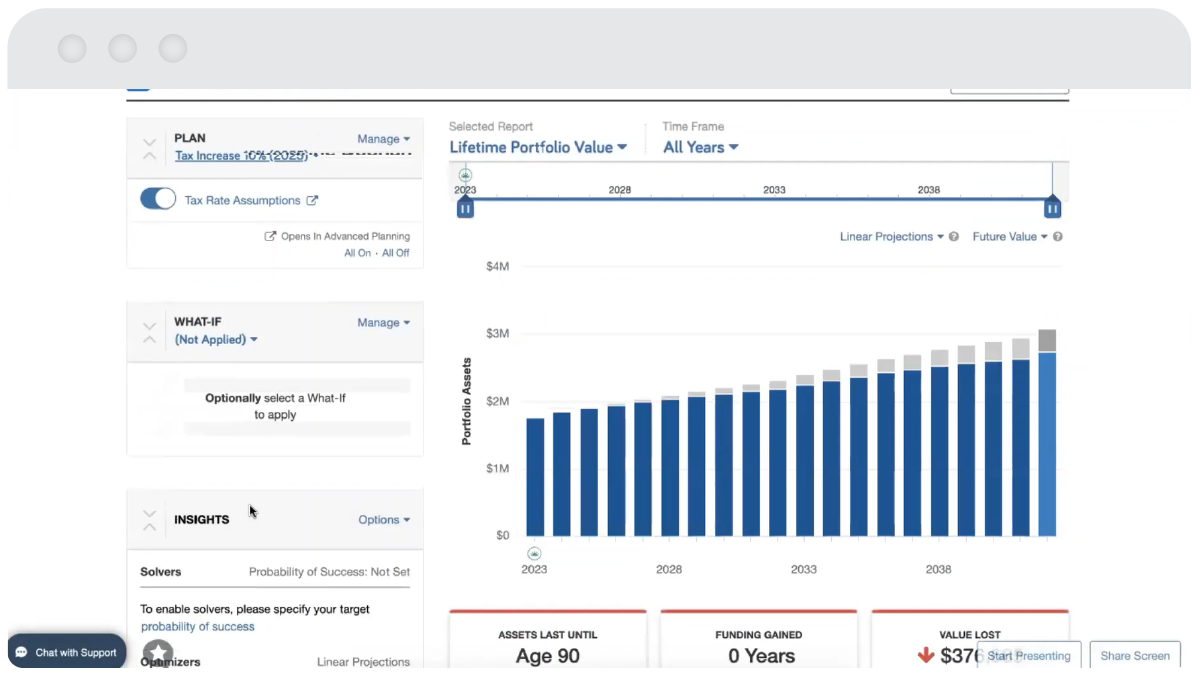

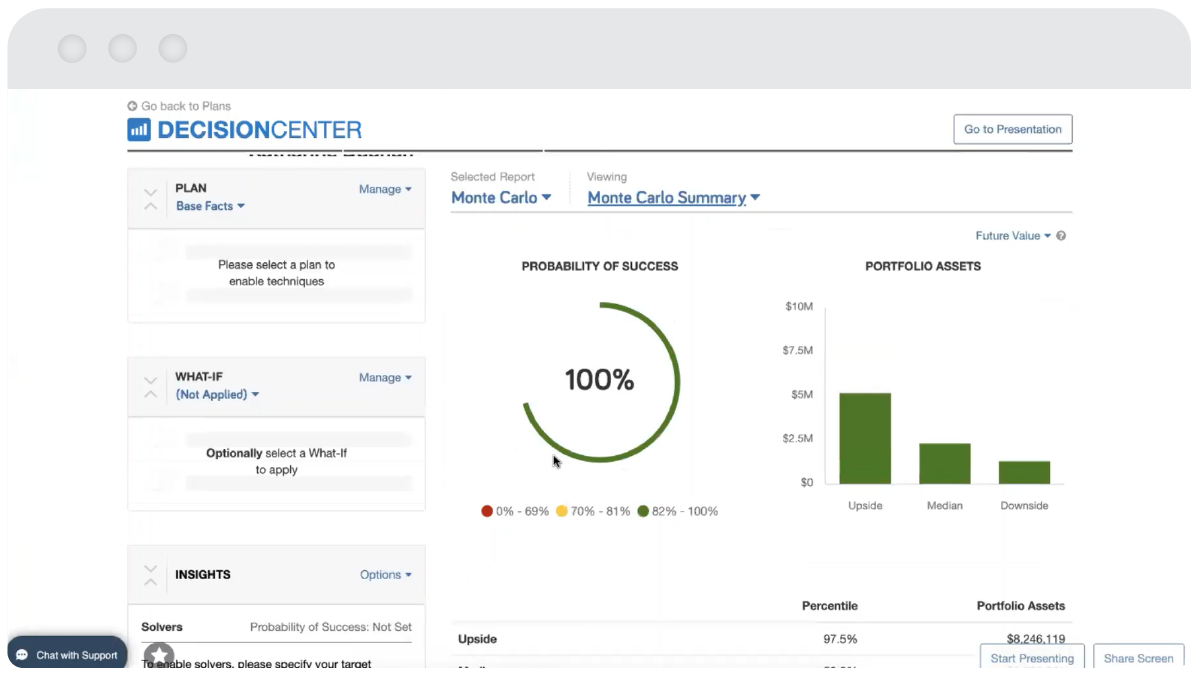

Determines your preparation for retirement and calculates your probability of success

in real time.

From the comfort of your own home or office

Appointment Request Form

Navigating the complex world of finance can be overwhelming, especially when it comes to retirement planning. That’s why Confidence Wealth Management takes a comprehensive approach to wealth management. We educate and guide you through the four phases of retirement: Accumulation, Preservation, Distribution, and Transfer.

We tailor a savings strategy designed to maximize our clients’ potential for long-term wealth accumulation. We focus on a diversified investment portfolio specific to you.

We manage the risks of market volatility and economic downturns to protect client assets, minimize loss and maintain financial stability.

Confidence Wealth Management LLC (CWM) is an SEC registered investment adviser. Confidence Wealth & Insurance Solutions LLC (CWIS) is licensed under the NV Department of Insurance, license no. 3647322. CWM and CWIS are two separate affiliated companies. All investment advisory services are provided by CWM and all insurance products and services are provided by CWIS. CWIS does not provide any investment advisory services and CWM does not provide insurance services. CWM and CWIS have no affiliation with government, state, or local agencies. Consult with an attorney or CPA for usage of tax or legal concepts. This material may contain information that are close approximation to the totality of information available to us and not necessarily specific within regards to one situation or another. Some opinions and statements are informational. They are not investment advice as they may not be complete in terms of all details needed to affect an action you wish to undertake, investment strategy or plan. Pursuant to IRS Circular 230, the material is not intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. No estimates used are a promise of return. Also, many opinions are summaries and may not reflect all pertinent facts relevant to you. Any information given is to be considered general, and nothing said herein should be used as a basis for investment decision unless you consult with your Confidence Wealth advisor that can understand your unique situation and give you a customized solution with a complete disclosure. Past performance does not indicate future results. As you know, no one can predict the future. Thus, any forecast in this material is intended strictly as a possible future outlook and not a statement of fact as there could be any scenarios that are not in your favor when making a decision. You must examine all adverse and negative implications on any forecast when made. All information is based on the date of the material and may not be valid, may change, and/or may not be true any longer as time passes.

Form ADV Part 2A for CWM contains detailed disclosures regarding our services and fees, along with applicable conflicts and how we address such conflicts. A copy of our Form ADV can be obtained by calling (310) 824-1000 or from adviserinfo.sec.gov